"Regulation is coming" has been the crypto boogeyman for years.

Every time a government says anything about crypto, Crypto Twitter goes crazy with "they're killing crypto!" or "this is incredibly bullish!" Neither side is right. Honestly? Both are exhausting.

The truth is more nuanced.

Let me break down what's actually happening and what it means for you.

The Global Landscape

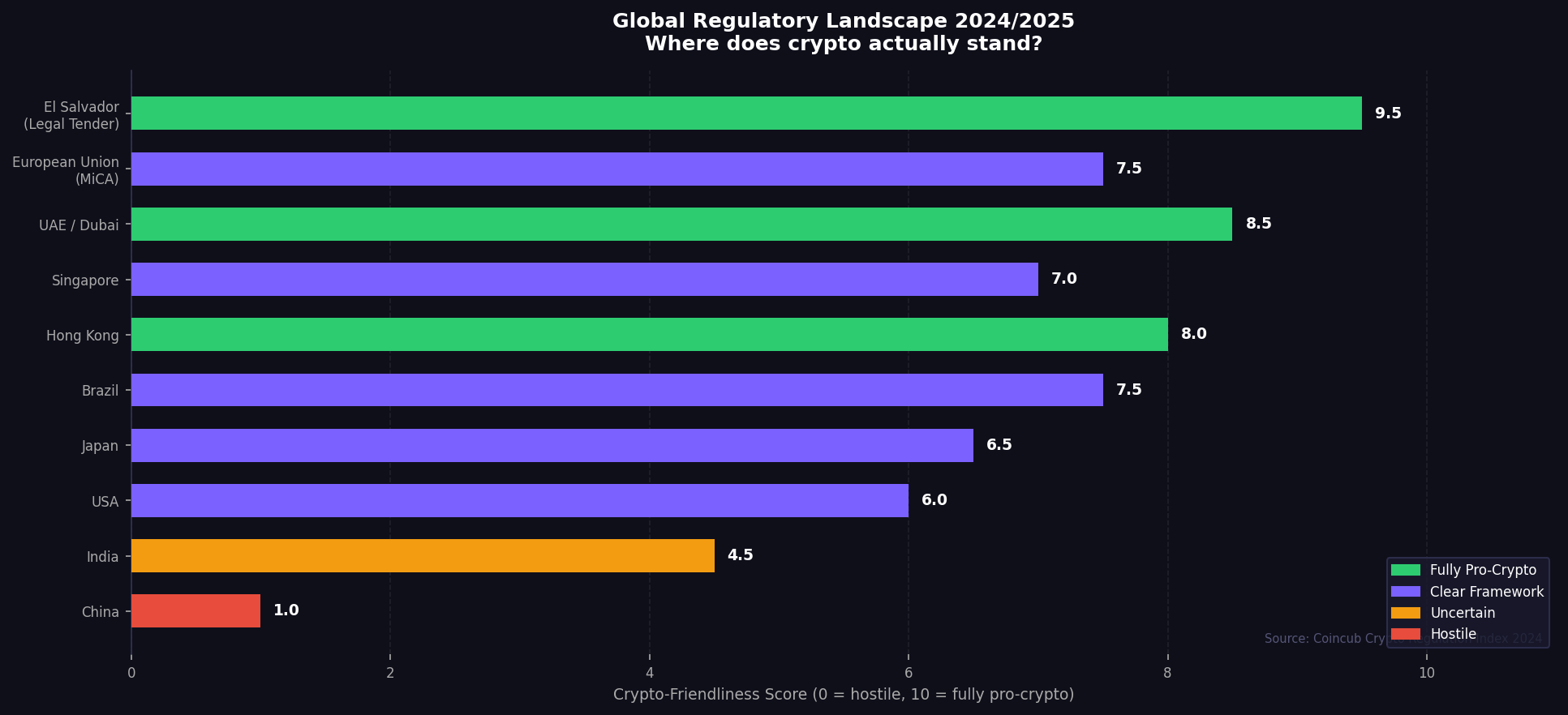

Source: Coincub Crypto Regulation Index 2024 — crypto-friendliness scores by region.

Different regions are taking wildly different approaches.

United States: After years of "regulation by enforcement" (which was a mess, let's be honest), the US is finally moving toward actual clear frameworks. The Bitcoin ETF approval in January 2024 was a watershed moment. 🇺🇸

European Union: MiCA is the most comprehensive crypto regulation in the world. Clear rules for issuers, exchanges, stablecoin providers. Love it or hate it, at least businesses have something concrete to work with.

Asia: Mixed bag. Hong Kong is positioning itself as a crypto hub. Singapore is crypto-friendly but tightening retail access. Japan has one of the most mature frameworks out there. China? Still hostile, but their citizens are still using it. 🤷🏻

Emerging Markets: This is where it gets really interesting for me. El Salvador adopted Bitcoin as legal tender. Brazil passed comprehensive crypto legislation. UAE is aggressively courting crypto businesses. These countries see the opportunity. 🇧🇷

What "Regulatory Clarity" Actually Means

When the industry says it wants "regulatory clarity," it means a few specific things.

Clear definitions: is a token a security, commodity, or something else? Different labels mean completely different rules.

Licensing frameworks: what do you actually need to legally operate a crypto business?

Consumer protections: what happens when exchanges collapse? (Hi FTX, we remember you)

Tax guidance: how do you report this stuff without guessing?

Clarity doesn't mean zero regulation. It means knowing what the rules are so you can actually follow them. That's it.

Why Most Hot Takes Are Wrong

"Regulation will kill crypto." No it won't. Regulation will kill scams and poorly-run exchanges. Legitimate projects thrive in a regulated environment because institutional money requires it.

"No regulation is best." Also no. The Wild West era gave us FTX, Terra/Luna, and dozens of rug pulls. Some consumer protection is necessary for mass adoption. We learned this the hard way. 🤯

"Just move offshore." This worked in 2017. It doesn't work in 2026. Regulatory arbitrage is getting harder as countries coordinate. That ship has sailed.

The Bitcoin ETF Moment Changed Everything

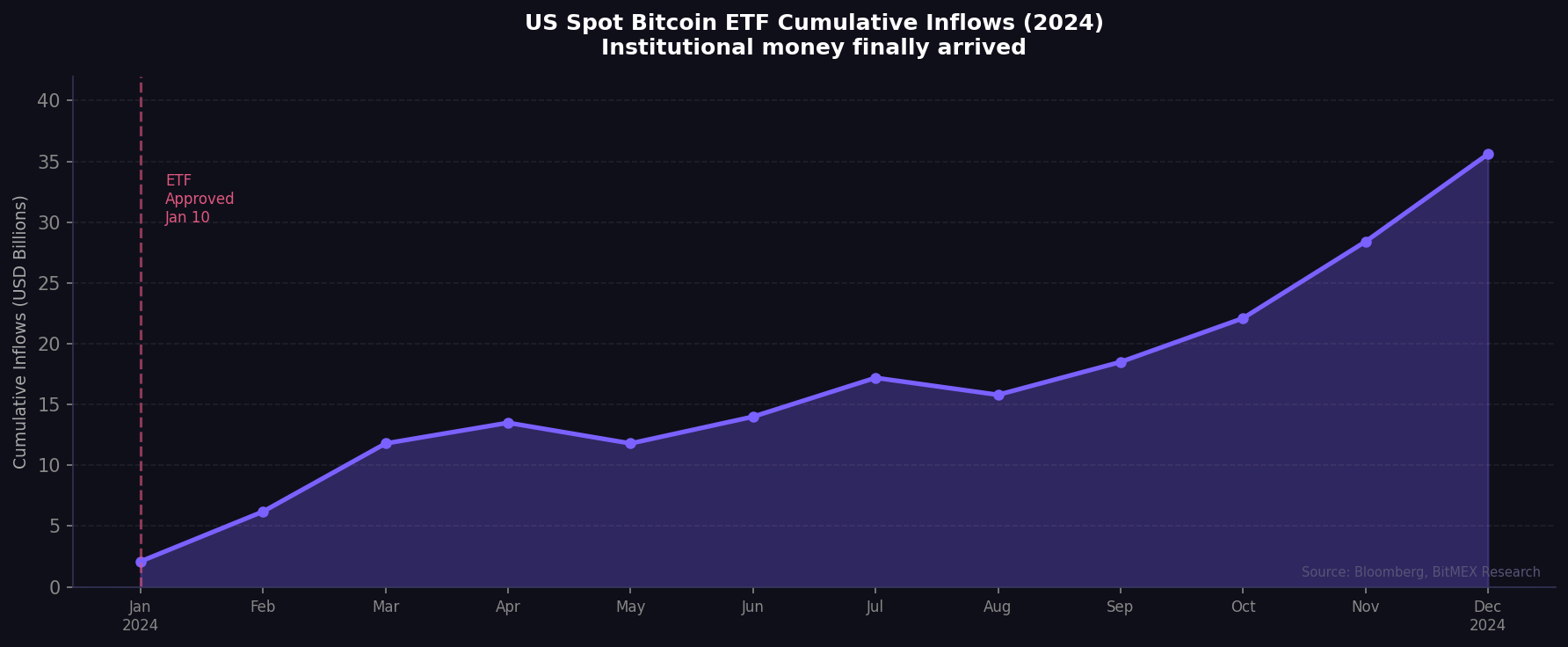

Source: Bloomberg Intelligence, BitMEX Research — US Spot Bitcoin ETF cumulative net inflows, 2024.

January 2024 was a turning point. The SEC finally approved spot Bitcoin ETFs and $35 billion flowed in during the first year alone.

Pension funds. Endowments. Sovereign wealth funds. Institutions that literally cannot invest in unregulated assets. They need regulatory clarity before they can touch crypto, and now they have it.

That's not "regulation killing crypto." That's regulation unlocking trillions in capital that was sitting on the sidelines. 💎

What This Means for You

If you're a long-term investor, regulatory clarity is overwhelmingly positive.

Institutional adoption accelerates. Better infrastructure gets built. Scams become harder to pull off. The market matures.

Yes, some DeFi protocols will get squeezed. Yes, some jurisdictions will make it harder. That's the price of legitimacy. And legitimacy is what brings the next 100 million users into crypto.

The Bottom Line

The crypto industry is growing up. Real rules, real accountability, real consequences for bad behavior. Also real adoption, real institutional capital, and real utility.

Stop fear-mongering about regulation. Start understanding it. The people who thrive in the next era of crypto will be the ones who work with the system, not against it. 📋💎

References

MiCA Regulation — European Parliament

SEC Approves Spot Bitcoin ETFs — SEC.gov

El Salvador Bitcoin Law — Reuters

Brazil Crypto Regulation Overview — CoinDesk